If you’ve ever clicked over to a financial news channel, you’ve probably heard the term “the Fed.” But who, or what, exactly is the Fed? And why does it matter to you?

Here, we explain the Federal Reserve System, or the Fed, and explore how its decisions affect us all as Americans.

What is the Fed?

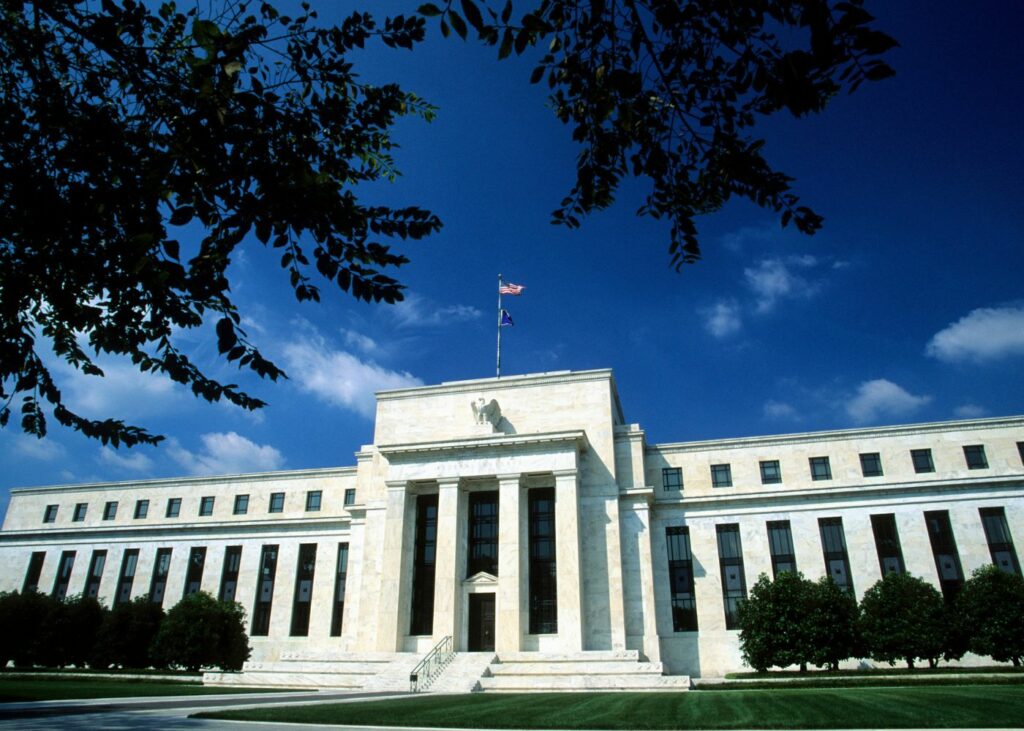

“The Fed” stands for the Federal Reserve System, the USA’s central banking system. It was established by Congress in 1913 and is an independent entity that was designed to promote the health of the U.S. economy and the stability of the U.S. financial system.1

The Fed has five general functions, including:

- Conducts the nation’s monetary policy

- Promotes the stability of the financial system

- Promotes the safety and soundness of individual financial institutions

- Fosters a safe and efficient payment and settlement system

- Promotes consumer protection and community development

The Fed also has dual objectives, which are often referred to as the dual mandate.2 The first objective is to promote maximum sustainable employment, which translates to as many Americans having jobs as possible while keeping inflation steady. The second objective is to maintain stable prices for the goods and services we purchase. In doing so, the Fed aims to foster a healthy economic environment in which businesses can grow and people can build wealth.

How Often Does the Fed Meet?

The Federal Open Market Committee (FOMC) is the branch of the Fed that is responsible for making decisions about the money supply and interest rates and meets regularly to evaluate the economic conditions and adjust its policies accordingly.3 The FOMC meets eight times a year, or about every six weeks. It consists of twelve members: seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four rotating Reserve Bank presidents.

The FOMC’s discussions and decisions significantly impact the nation’s economy. In the FOMC meetings, the Fed makes crucial decisions about monetary policy, especially around the federal funds rate, which is the interest rate at which banks lend to each other. This rate indirectly affects other interest rates, such as those for mortgages, car loans, and credit cards, as well as the rates paid on savings accounts and money market funds.

The Fed also makes decisions about quantitative easing measures, which involve the Fed buying government securities or other securities from the market to lower interest rates and increase the money supply, encouraging lending and investment.4

How the Fed Impacts You

Decisions made by the Fed have a direct impact on the average investor. When the Fed raises or lowers interest rates, the cost of borrowing and the return on savings and investments are impacted.

When the Fed lowers interest rates, borrowing becomes cheaper, which can lead to increased spending by consumers and businesses. This surge in demand can boost the economy and potentially lead to higher stock prices. However, lower interest rates mean savers and investors earn less on their money, which can push them to look for higher returns for their investments.

Conversely, when the Fed raises interest rates, borrowing becomes more expensive, which can slow economic activity. This can lead to lower stock prices, as businesses might see their revenue decrease, and consumers may cut back on spending. However, savers and bond investors can benefit from higher interest rates as they earn more on their cash and fixed income investments.

The Fed plays an instrumental role in steering the economic course of the nation. Its decisions affect not only big businesses and banks but also the average American and their financial future. By understanding the workings of the Fed and its influence on the economy, individual investors can make more informed decisions that lead to better financial outcomes.

Spiritual Application

It can be so easy to criticize the decisions those who are in authority make, especially when we can feel the consequences during the course of our everyday lives. Whether we agree or disagree with the decisions made by those in positions of power, our focus can be quickly pulled to the person, or group of people in authority and what they are, or aren’t doing right. However, the Bible is clear that we are to redirect that focus to ourselves by choosing to honor those who are in authority. Romans 13:1-4(NIV) reads, “Let everyone be subject to the governing authorities, for there is no authority except that which God has established… Do you want to be free from fear of the one in authority? Then do what is right and you will be commended.”

There is a clear distinction to make between honor and agreement. We are not required to agree with everything that someone in authority does. In fact, we should be paying close attention to the words and actions of those who are in authority since we carry the voting power to keep or remove them from the position of authority. However, honor is an attitude, not an implication of agreement. The definition of honor is “to hold in high respect.” Have you ever had to respect someone’s decision even if you didn’t agree with it? While it’s never an easy task to keep our own opinion in check if we disagree with someone, we can see that continuing to honor them and their position is important. And this leads to greater future rewards for us than making our own opinion heard.

Interested in working with us?

Schedule A CallKnow someone who might be interested in working with us?

Fill out our referral form- https://www.federalreserve.gov/aboutthefed.htm

- https://www.investopedia.com/articles/investing/100715/breaking-down-federal-reserves-dual-mandate.asp

- https://www.investopedia.com/terms/f/fomc.asp

- https://www.forbes.com/advisor/investing/quantitative-easing-qe/

This content is developed from sources believed to be providing accurate information. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Evergreen Financial Group, LLC is a registered investment advisor offering advisory services in Montana and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. All opinions and estimates constitute Evergreen Financial Group’s judgement as of the date of this communication and are subject to change without notice. Evergreen Financial Group does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk.