“It’s not what you make, it’s what you keep.” This quote rings true regardless if you’re talking about income, saving, or investing. There is no shortage of places where our income can turn into an outflow. One of the most well-known outflows we encounter this time of year comes in the form of taxes. Let’s dive into these strategies deeper.

5 Ways to Implement Tax-Efficient Investing

In this post, we examine five ways that we can keep the increase to keep our hard-earned money from turning into excess tax payments:

1. Take advantage of Tax-Exempt Interest and Qualified Dividends

If you are investing in a non-qualified account such as an individual, joint, or revocable trust, ordinary interest and dividends are taxed at ordinary income tax rates. However, certain types of income, such as interest on bonds issued by local governments and municipalities, qualify as federally tax-exempt interest. While the interest on these bonds is still subject to state tax, state tax rates are generally lower than federal tax rates.

Another way to reduce the amount of tax outflows in non-qualified investment accounts is by taking advantage of qualified dividends. The definition of a qualified dividend is: “The dividend from a stock held for more than 60 days in the 121-day period that began 60 days before the ex-dividend date.” An easy way to think of this is that the longer you hold a dividend-paying security, the more of its dividends will be taxed at lower rates.

The advantage of qualified dividends is that a qualified dividend is taxed at lower capital gains tax rates as opposed to ordinary income tax rates. While an investment shouldn’t be evaluated just on its dividends alone, keeping more of the income translates into a greater after-tax portfolio return, and ultimately a greater portfolio value.

2. Practice Tax-Loss Harvesting

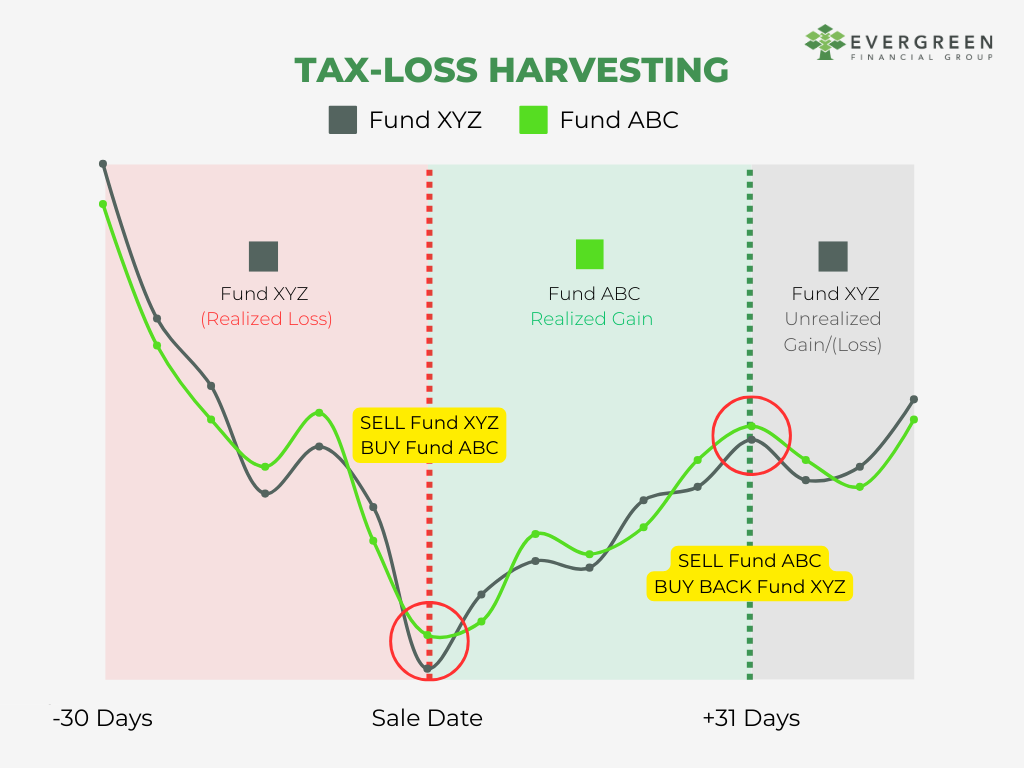

Tax-Loss Harvesting(TLH) has become a fairly common strategy in the past decade or so. With the rise of technology and automated software, a TLH trade can be executed in multiple portfolios with the push of a button. During down markets or times of volatility, TLH can help to offset the tax obligation from other dividends or interest, while keeping the overall portfolio allocation in line. Another added benefit of TLH is that it can be used to offset gains in other capital assets, such as investment real estate.

One caveat to be mindful of when executing TLH trades is the Wash Sale Rule. Buying a substantially similar security within the 61-day window of a sale at a loss can potentially disallow the loss on the current sale and defer it to the repurchase. Making sure the repurchased security is substantially different is key to avoiding triggering the rule. A common way to go about this is to select a security that tracks a different index while still having similar performance behavior.

3. Use Effective Tax Location

Tax location is the practice of selecting the best assets for the best account types. Tax-exempt bonds are a very tax-efficient investment and are best suited for non-qualified account types that fully maximize the tax-free benefits. However, higher growth-oriented or tax-inefficient investments are best suited for qualified account types, such as IRAs, 401ks, or HSAs. Review our blog post on The 4 Key Asset Buckets in Retirement for a more detailed explanation.

If you find yourself having the majority of your investments in only one type of bucket, you may consider ways to increase tax diversification across your accounts. A few examples of this would be to contribute money from a non-qualified account to a Traditional or Roth IRA, or converting money from a Traditional IRA to a Roth IRA in a low tax year or when the market is down. Keep in mind the income and contribution limits when making contributions to IRAs.

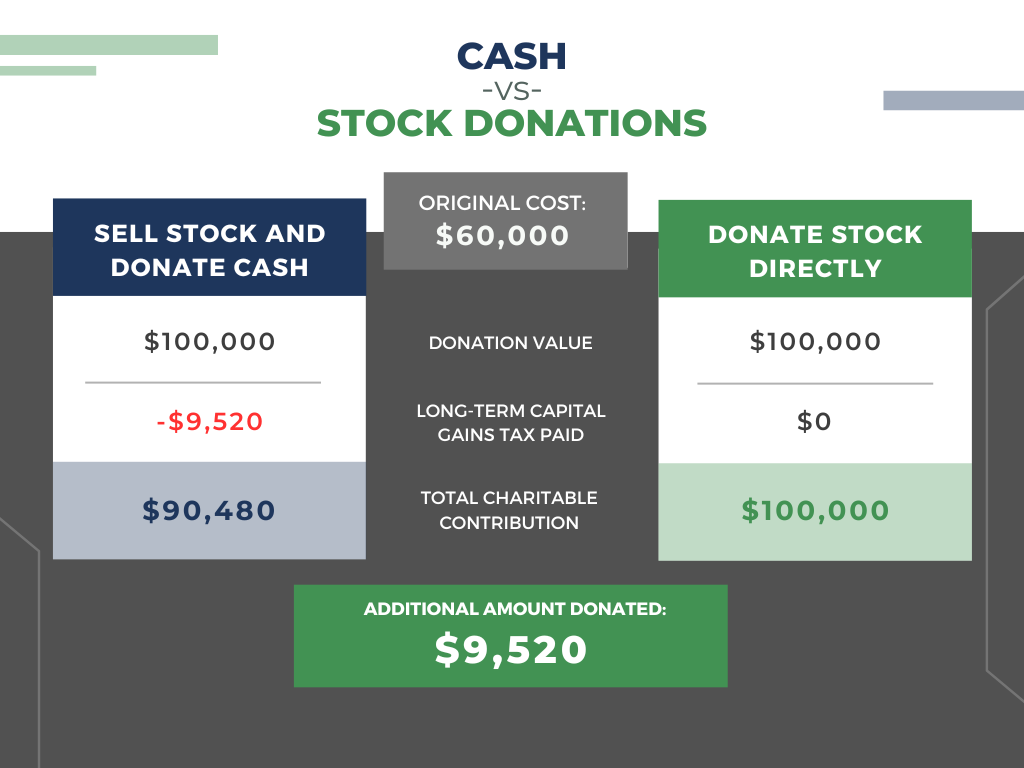

4. Gift from Appreciated Stock

A fourth way to increase a portfolio’s total after-tax return is by using appreciated assets to gift from. If you practice giving to individuals or charity, there are multiple tax benefits. Transferring an investment directly from your non-qualified brokerage account to a charity allows you to avoid paying capital gains tax on the sale of the investment while usually getting a tax deduction on the full market value of the investment(depending on Adjusted Gross Income). See our blog post on 3 Tax-Efficient Strategies for Charitable Giving to learn more.

Another way to practice tax-efficient investing is to gift appreciated securities directly to a child or minor’s brokerage account. If the recipient minor has a UTMA/UGMA account, the sales are reported in their name as opposed to the one who purchased the investment. If the minor has little or no income, the sale can be realized at very low income or capital gains tax rates, effectively reducing the tax implications to little or nothing. This can also be practiced every year as the minor’s income “resets”, effectively creating a great annual tax-efficient gifting opportunity. Keep in mind the kiddie tax rules when a child has unearned income.

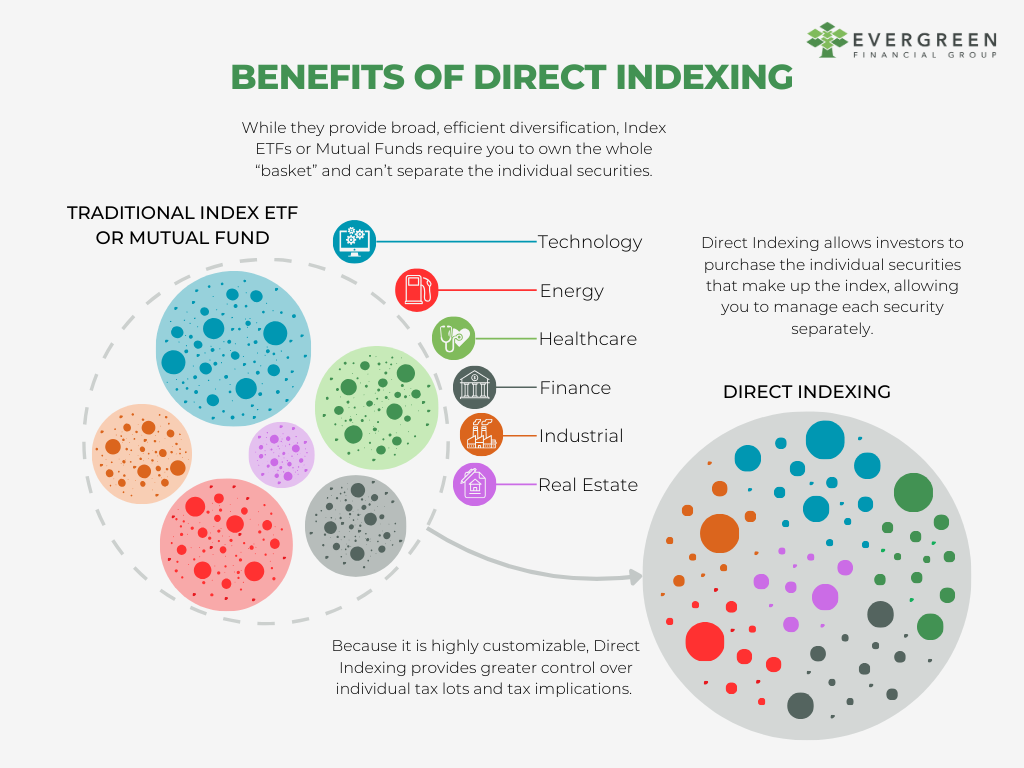

5. Use a Direct Indexing Strategy

A final way to practice tax-efficient investing is through the use of a Direct Indexing strategy. Direct Indexing has recently grown in popularity and use due to its ability to capitalize on the benefits of low-cost index investing while being able to take advantage of the short-term fluctuations of the underlying companies making up the index. While the most common way of investing in a broad-based index continues to be through the use of a mutual fund or exchange-traded fund, a Direct Indexing strategy takes that a step further and purchases most of the securities in that index. This allows an investor to strategically monitor all of the individual securities for tax opportunities, such as generating a short-term loss that can be used to offset future gains.

For instance, an investor might use a Direct Indexing strategy to invest in the S&P 500. While he or she expects the index as a whole to do well over the long term, there might be a handful of stocks in the index that go down during the time they’ve invested in the strategy. That investor may intentionally sell the stock(s) that have gone down to generate the loss, and then repurchase another security in that index that may carry similar characteristics as the one that was sold. For example, if Ford stock is trading down from the investor purchasing it, they may decide to sell it and repurchase General Motors(GM).

Another advantage of this strategy is that it allows an investor to continue holding appreciated or concentrated positions that might otherwise have tax consequences if they are sold. By essentially “plugging in” the existing holdings into a broader indexing strategy, the investor can continue holding some or all of the shares that are concentrated, while still spreading out their risk through broad diversification in the rest of the index. The investor can decide if he or she wants to begin divesting from their appreciated investments by generating intentional losses that can be used to offset gains from selling the appreciated securities.

Maximize Your Returns with Evergreen

While successful tax management can seem like a chore, the long-term benefits still outweigh the time and effort spent to put it into practice. Financial goals may seem far out of reach alone but with a financial advisor by your side, we can simplify the process.

If you don’t have an effective tax-efficient investing plan, register for our upcoming webinar today: 5 Effective Methods for Tax-Efficient Investing to find out how we can help you put yours into place.

Interested in working with us?

Schedule A CallKnow someone who might be interested in working with us?

Fill out our referral formThis content is developed from sources believed to be providing accurate information. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Evergreen Financial Group, LLC is a registered investment advisor offering advisory services in Montana and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. All opinions and estimates constitute Evergreen Financial Group’s judgement as of the date of this communication and are subject to change without notice. Evergreen Financial Group does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk.